Filing the MCS-150 form is a critical requirement for all motor carriers operating under a USDOT number. Whether you’re updating your information or completing the biennial filing, accuracy and timeliness are key to avoiding fines and staying compliant with Federal Motor Carrier Safety Administration (FMCSA) regulations. This form is mandatory for all carriers involved in interstate commerce. It plays a crucial role in keeping your USDOT number and company records up to date with the Federal Motor Carrier Safety Administration (FMCSA).

Let’s take a closer look at the MCS-150 form—what it is, who needs to file it, why it’s important, and how to fill it correctly—to better understand its role in maintaining FMCSA compliance.

What is Form MCS-150?

The MCS-150 is a crucial form required by the Federal Motor Carrier Safety Administration (FMCSA) for all businesses operating commercial vehicles. Whether you’re obtaining your USDOT number or updating your existing record, this form is the primary tool for providing accurate and current information to the FMCSA.

Companies are required to use Form MCS-150 to report key details such as their business name, address, number of vehicles, types of cargo transported, and overall scope of operations. Every motor carrier must review and update its information at least once every two years, even if no changes have occurred. Additionally, any time your company makes changes, like a new business address or a change in operations, you’re expected to update your USDOT and Operating Authority records promptly.

But filing this form isn’t just about compliance—it’s about safety, accountability, and keeping your business running without interruptions. An up-to-date MCS-150 helps ensure your company stays in good standing with the FMCSA, avoids penalties, and maintains active operating authority. Whether you’re a new entrant or an established carrier, keeping your MCS-150 current is a small step that makes a big impact on staying legal and road-ready.

What is Form MCS-150 used for?

Motor carriers use the form MCS-150 to keep their registration details accurate and up to date with the FMCSA.

Here’s what the MCS-150 is used for:

- Registering a new motor carrier with the FMCSA

- Updating business information, such as contact details, number of vehicles, or types of operations

- Reporting any changes in your company’s operations

- Staying in compliance with federal trucking regulations

Who is required to fill out Form MCS-150?

You’ll need to file Form MCS-150 if you fall into any of the following categories:

- Motor carriers operating commercial vehicles in interstate or intrastate commerce

- Freight forwarders and brokers involved in arranging or managing freight transportation

- Businesses that need to update or correct existing motor carrier registration details

- Any entity that wants to maintain an active USDOT number—this form is required to keep it valid

This MCS-150 form is your way of keeping the FMCSA informed about your business operations. Once submitted, both the FMCSA and state agencies use the information to oversee safety standards and enforce transportation regulations across the industry.

Who is exempted from filing Form MCS-150?

Not every business in the transportation industry needs to file Form MCS-150. If your operations are limited to one state and you don’t cross state lines—or engage in any form of interstate commerce—you’re not required to submit this form.

The same goes for certain exempt vehicles, like some farm-related equipment or operations that fall outside the scope of federal safety regulations. However, it’s always a smart move to double-check with the FMCSA or your state’s transportation authority to make sure your specific situation qualifies for an exemption.

When to file Form MCS-150?

Form MCS-150 must be updated every two years, based on the original date your USDOT number was issued. This is known as your biennial update. You’re also required to file it any time there’s a significant change to your company’s information, like adding vehicles, changing your business address, or updating your operations.

Know when your MCS-150 is due before you miss it.

Failing to submit the MCS-150 form on time may lead to penalties or even the deactivation of your USDOT number. To stay on top of it, mark your renewal date on your calendar or set a reminder. And if your business details change before your scheduled update, go ahead and file the form early.

MCS-150 instructions: How to complete and update the MCS-150 Form

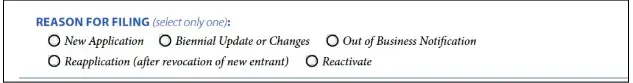

Before you begin filling out Form MCS-150, it’s important to understand why you’re filing it. At the top of the form, you’ll find a section labeled “Reason for Filing.” You’ll need to choose one of four filing options based on your current situation. The option you select will determine which parts of the form you need to complete.

Here’s a quick breakdown to help guide you:

| If you want to… | Select this option (Reason for Filing) | Form items to complete |

| Apply for a USDOT number for the first time | NEW APPLICATION | All items (1–31), except 16 and 28 |

| File a biennial update or update business information | BIENNIAL UPDATE OR CHANGES | Items 1–16, 21, 30-31, and any others where the information has changed |

| Notify FMCSA that your business is no longer operating interstate | OUT OF BUSINESS NOTIFICATION | Items 1–16 and 30–31 |

| Reapply after your New Entrant registration has been revoked | REAPPLICATION (AFTER REVOCATION OF NEW ENTRANT) | All items (1–31); enter previous USDOT number in item 16 |

| Reactivate your inactive USDOT number | REACTIVATE | All items (1–31); enter USDOT number in item 16 |

To complete the MCS-150 form, begin by collecting your USDOT number, PIN, and all necessary company details. Carefully review the instructions and ensure every required section is accurately filled out. Once finished, submit your form online.

What information is needed for MCS-150?

When filing the MCS-150 (Motor Carrier Identification Report), you’ll be required to have the following information:

- Business Information: Your legal business name, USDOT Number, mailing address, and primary contact details.

- Vehicle Details: The total number of commercial vehicles you operate, along with a breakdown by vehicle type (e.g., straight trucks, tractors, trailers).

- Mileage Estimates: Your fleet’s total carrier mileage over the past year, rounded to the nearest 10,000 miles.

- Driver Information: The number of drivers operating under your authority, including both interstate and intrastate drivers.

- Type of Carrier Operation: Identify your operational classification—such as a private carrier, for-hire carrier, or broker.

- Cargo Classification: List the categories of cargo you transport, such as general freight, hazardous materials, refrigerated goods, etc.

How to fill out each field on the MCS-150 Form?

Filing Form MCS-150 online is the FMCSA’s preferred method—it’s quicker, more efficient, and helps minimize mistakes. However, if you’re more comfortable with paper forms, mailing them in is still an option. Below is a simplified breakdown of all 31 sections of the form, along with what each one means and what information you’ll need to provide:

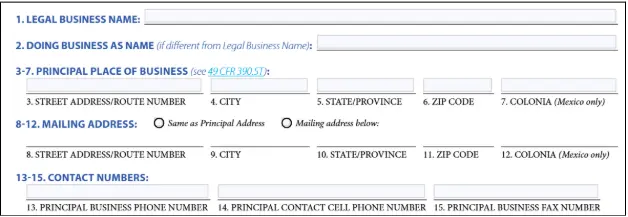

1. Legal Business Name

This is the official name of your company—the one listed on your legal documents, such as your incorporation papers, tax forms, or partnership agreement. Make sure to enter the full name exactly as it appears in those records. If your business is a corporation or LLC, don’t forget to include the proper suffix (like “Inc.” or “LLC”).

2. Doing Business As (DBA)

If your company uses a different name publicly than your official legal business name (the one you entered in item 1), this is where you put that trade name. If your business name and your operating name are the same, simply leave this section blank.

3–6. Physical Address

Provide the actual street address where your company conducts its transportation-related activities and keeps its safety records. This should be your main office, garage, or warehouse—the real spot where business happens. Keep in mind, a P.O. Box won’t work here, and neither will the address of a consultant or attorney unless they’re directly involved in your transportation operations at that location.

7. Colonia

This section only applies if your business’s main address is in Mexico. If that’s not the case, you can skip it. But if your principal place of business and safety records are located in Mexico, please enter the specific “Colonia” or neighborhood where your company is based.

8–11. Mailing Address

This is where you want the FMCSA to send all official mail and correspondence. It can be your business address, your home, or even a P.O. Box. If your mailing address is the same as your physical business address (items 3–6), simply check the box labeled “Same as Principal Address”—then you can skip filling out items 8 through 11. But if your mailing address is different in any way, choose “Mailing address below” and fill in all the details for items 8 to

12. Colonia (Mailing Address)

If your company’s mailing address is in Mexico, be sure to enter the specific “Colonia” or neighborhood to help provide a complete address for correspondence.

13. Principal Business Phone Number

Provide the main phone number for your business location, Principal Place of Business” (from items 3–6), including the area code. This can be either a landline or a cell phone—whichever is the best way to reach your business.

14. Principal Contact Cell Number

Provide the cell phone number, if any, including area code. If this is the same as the “Principal Business Phone Number” (item 13), enter “Same”.

15. Principal Business Fax Number

Enter the company’s fax number, if any, including area code. If this is the same as the “Principal Business Phone Number” (item 13), enter “Same”.

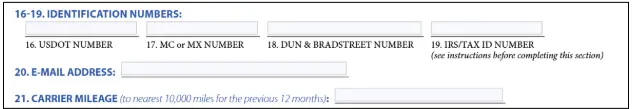

16. USDOT Number

If your company already has a USDOT number—meaning you’ve filed before—go ahead and enter that number here. If you’re applying for the first time and don’t have a USDOT number yet, just leave this section blank.

17. MC or MX Number

If your company has been given an MC or MX number by the FMCSA—even if it’s still pending—enter it here. This number is usually tied to your authority to operate in interstate commerce. If you’ve filed this form before and the number hasn’t changed, you can leave this field blank.

18. Dun & Bradstreet Number

If your business has a Dun & Bradstreet number—often used for tracking business credit—enter it here. If you’ve submitted the MCS-150 before and your D&B number hasn’t changed, you can leave this blank. Not sure what your number is? You may need to contact D&B to retrieve it.

19. IRS/Tax ID Number

Enter your company’s Employer Identification Number (EIN) as issued by the IRS. If you’re a sole proprietor and don’t have an EIN, you can use your Social Security Number instead—but the FMCSA strongly encourages getting an EIN for registration purposes. If you’ve already filed before and your EIN hasn’t changed, you can skip this field.

20. Email Address

Provide the primary email address you use for your business. This is how the FMCSA may reach out with important updates or requests, so make sure it’s one you check often.

21. Carrier Mileage

Report the total number of miles your commercial vehicles have traveled over the past 12 months. Round this number to the nearest 10,000. If you’ve been in business for less than a year, enter your mileage to date. If there has been no activity in the past year, simply enter “0.”

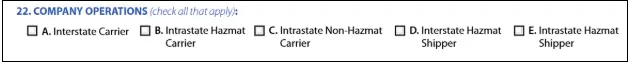

22. Company Operations

Choose the option that best describes what your business does. Most carriers will select “Interstate Carrier,” meaning you operate across state lines. If you’re only shipping hazardous materials but not operating vehicles, you likely don’t need a USDOT number. Select all that apply to your business:

- Interstate Carrier – Transports goods or passengers that cross state lines or are part of interstate commerce.

- Intrastate Hazmat Carrier – Hauls hazardous materials within one state only, never crossing state or national borders.

- Intrastate Non-Hazmat Carrier – Transports non-hazardous materials strictly within one state.

- Interstate Hazmat Shipper – Offers hazardous materials for transport across state or national borders; may or may not provide transport.

Intrastate Hazmat Shipper – Offers hazardous materials for transport only within one state; does not operate across state lines.

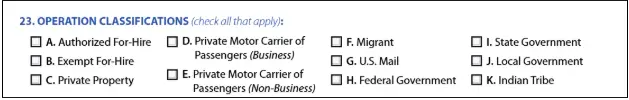

23. Operation Classification

Operation classification defines the kind of business your company performs and determines which FMCSA rules apply to you. It also helps identify whether you need Interstate Operating Authority. Since your operations may fall under more than one classification, it’s important to review the options carefully and select all that apply. Here are some of the operation classifications:

- Authorized For-Hire – Paid to transport passengers or regulated goods/household items owned by others.

- Exempt For-Hire – Paid to transport only FMCSA-exempt goods or operates solely within exempt commercial zones.

- Private Property – Transports its own products as part of its business operations.

- Private Motor Carrier of Passengers (Business) – Moves passengers interstate for business purposes, not open to the public.

- Private Motor Carrier of Passengers (Non-Business) – Transports members (e.g., church, school) interstate for non-commercial purposes.

- Migrant – Contract-based interstate transport of three or more migrant workers using non-passenger vehicles.

- U.S. Mail – Moves U.S. mail under contract with the Postal Service.

- Federal Government – Transport operated by a U.S. federal agency.

- State Government – Transport is operated by a U.S. state government agency.

- Local Government – Transport is managed by local government or municipalities.

- Indian Tribe – Transport provided by a federally recognized tribal government.

- Other – Any transport not listed above or brokered transport of property or household goods.

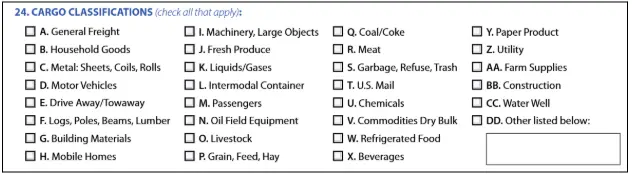

24. Cargo Classifications

Choose all the types of cargo your company hauls or ships. This can include general freight, liquids, hazardous materials, refrigerated items, and more. If you select “Other,” be sure to specify what that includes. Even if you’ve submitted this form before, double-check and update your selections if your cargo types have changed.

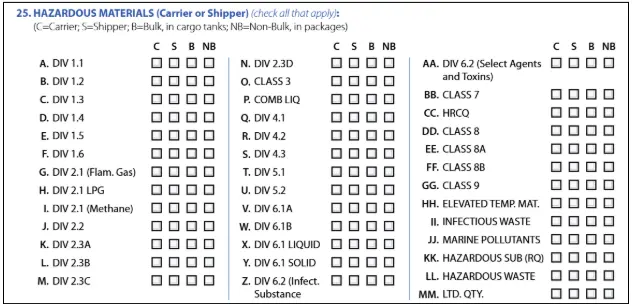

25. Hazardous Materials

Only complete this section if your company transports or offers Hazardous Materials for transport. If not, skip to item 26.

- Mark “C” for Carrier, “S” for Shipper, or both if your company handles both roles for any listed hazardous material.

- Use “B” for Bulk and “NB” for Non-Bulk based on how the hazardous materials are transported, following the definitions in 49 CFR 171.8.

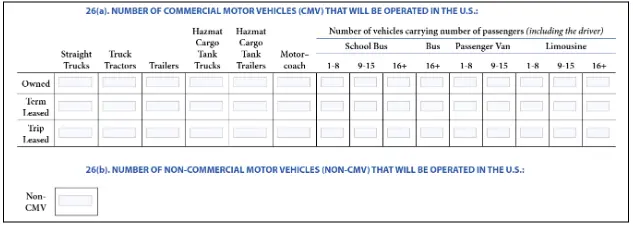

26. Number and Types of Vehicles

In this section, provide a count of the commercial motor vehicles (CMVs) your company uses in U.S. operations, categorized by ownership type:

- Owned – Vehicles your company holds the title for.

- Term-Leased – Vehicles leased for a set period under a contract.

- Trip-Leased – Vehicles leased on a trip-by-trip basis as needed.

Include all types of vehicles used to carry cargo or passengers, and separate them by type (straight trucks, trailers, passenger vans, buses, etc.). Count the driver as a passenger when calculating capacity.

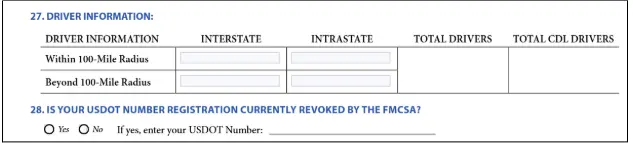

27. Driver Information

Report the average number of drivers operating commercial motor vehicles (CMVs) for your company each workday, broken down into:

- Interstate drivers (those who drive across state lines)

- Intrastate drivers (those who drive only within one state)

Include all types of drivers—full-time, part-time, casual, leased, or company-employed.

Also, provide: The total number of drivers involved in your operations, no matter their employment status, and how many of those drivers hold a valid Commercial Driver’s License (CDL).

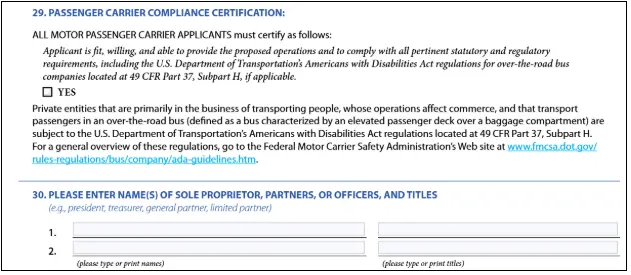

28. Revoked USDOT Number

If your company’s USDOT Number and registration have been revoked by the FMCSA, please enter your assigned USDOT Number in the space provided.

29. Compliance Certification (ADA)

This section must be completed by all passenger carrier applicants. Carefully read the statement and select “YES” only if it accurately applies to your business. This mainly concerns passenger carriers, such as bus companies. Ensure your operations comply with the ADA requirements. If this doesn’t apply to your business, you can leave this section unchecked.

30. Names of Company Officer

Provide the names and titles of key individuals in the company. If the business is a sole proprietorship, list the owner’s name and title. For partnerships, include the names and titles of two partners. For corporations, list two corporate officers such as President, Vice President, Secretary, or Treasurer. Make sure to include at least one person responsible for overseeing operations, like the owner, CEO, or operations manager.

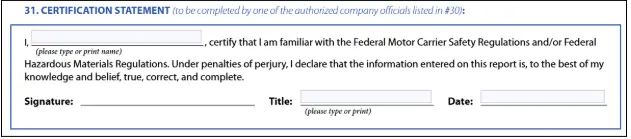

31. Certification Statement

Enter the name of the person authorized to sign official documents for the company named in item 1. This individual must sign, date, and print their name and title exactly as listed. The signer must also be one of the individuals listed in the previous section. By signing, they confirm that all the information provided is true and complete. Include the date of submission along with the signer’s details.

Where to file Form MCS-150?

You can file Form MCS-150 online through the Federal Motor Carrier Safety Administration (FMCSA) website. Filing online helps ensure your information is processed quickly and accurately, minimizing delays as long as all details are entered correctly.

If you prefer to file with the FMCSA, you can mail the completed form to the address provided on the FMCSA official website. Ensure to review the latest filing instructions before sending your application to ensure you follow the most current process.

Certain sections of Form MCS-150 require very precise and accurate information, and even minor mistakes can result in delays or complications during the processing of your application. To help avoid these issues, it’s a good idea to use a trusted MCS-150 service provider like eMCS150.com. These providers offer a secure and user-friendly platform that guides you through the filing process carefully, helping ensure all details are correct. Plus, with real-time confirmation and expert customer support, you can feel confident that your submission is accurate and complete. Our experienced team will walk you through the process step by step, ensuring everything is accurate and hassle-free.

Here’s a step-by-step guide on how to update MCS-150 online with eMCS-150.

Frequently asked questions on MCS-150 instructions

1. What should I put for mileage on an MCS 150?

When filling out the MCS-150 form, carriers are required to report the total annual mileage driven by all commercial vehicles in their fleet. This is known as the carrier mileage on MCS-150 and should reflect the most recent 12-month period of operation. The reported mileage must be rounded to the nearest 10,000 miles.

The FMCSA uses this information to evaluate a carrier’s safety performance and to assess whether further review or intervention is required. Providing incorrect or outdated mileage can affect your safety rating and compliance status, so make sure your records are current when submitting the form.

2. What happens if you don’t update your MCS-150?

If you fail to file your MCS-150 Biennial Update on time, your USDOT number may be deactivated, meaning you’ll no longer be authorized to operate legally. In addition to losing your operating authority, you could face civil penalties of up to $1,000 per day, with a maximum fine of $10,000.

3. What does “Exempt For-Hire” mean on the MCS-150 form?

The term “Exempt For-Hire” on the MCS-150 refers to motor carriers that transport exempt commodities—goods that are not subject to federal economic regulation—for compensation. These carriers operate as for-hire entities, meaning they are paid to haul goods that fall outside of FMCSA’s regulatory authority.

Exempt commodities typically include agricultural products like fresh fruits and vegetables, unprocessed or raw materials, and other low-value items that have not been manufactured or refined. Because these goods are not regulated under traditional freight transportation laws, carriers moving them are considered exempt from certain operating requirements, such as needing specific operating authority or tariffs.Even though they are exempt from some federal regulations, for-hire carriers must still comply with safety regulations and are required to file the MCS-150 to maintain an active USDOT number.